does wyoming charge sales tax on labor

If the main purpose of the transaction the true object is the sale of taxable property or equipment the entire transaction is subject to sales tax. Fees for labor are taxed when the labor is expended on a taxable item ie repairs to a vehicle.

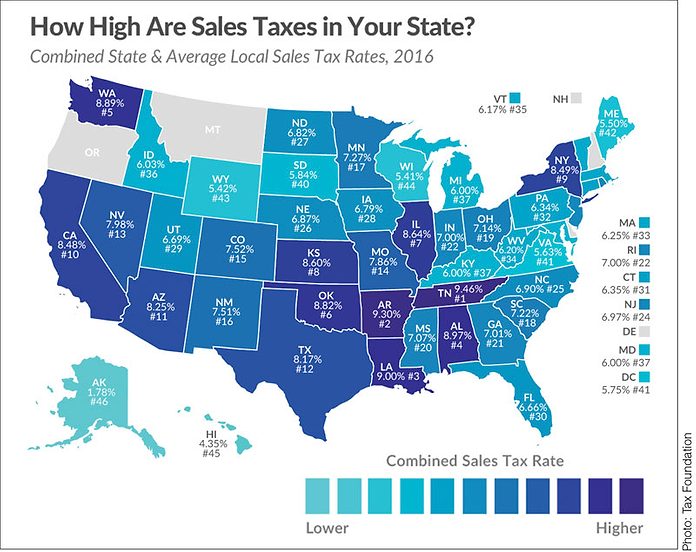

Ranking State And Local Sales Taxes Tax Foundation

You must collect sales tax at the tax rate where the item is being delivered.

. Under certain circumstances labor charges are taxable. However the business owner is required to pay sales tax when they purchase materials and are also required to calculate and remit use tax to the state themselves on their fabrication labor. Separately stated charges for installation remain treated as a non-taxable service.

If you charge your customer sales tax for various parts and materials you must be sure to charge the correct sales tax rate on that material. You should treat fabrication labor charges in the same manner if you include them into the price of your product regardless whether you itemize them or leave them alone. Taxpayer Specialists assigned to vendor operations work with vendors throughout the life of their business from licensing to cancellation.

Installing repairing cleaning improving constructing and. An example of taxed services would be one which sells repairs alters or improves tangible physical property. And since sales tax rates can vary from local area to local area its important that you calculate the right sales tax rate when itemizing a bill for time and materials.

However which labor and services may vary from state to state. Vendors and sellers must charge tax on both the amount associated with the property being sold and the delivery charges as defined in RC. The labor charge is not an itemized fee if you include labor charges separately on your invoice a Contractor Option 1 contractor wont charge you a fee for labor billed separately.

Do construction companies charge sales tax. Goods refers to the sale of tangible personal property which are generally taxable. Such real property improvements are not subject to sales tax.

Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. Are services subject to sales tax in Vermont. Admission and access privileges to amusement athletic entertainment or recreational places or events.

Alaska Delaware Hawaii Montana New Hampshire and Oregon. If the main purpose of the transaction is instead the sale of an exempt service the entire transaction is generally exempt. Construction services WAC 458-20-170 Constructing and improving new or existing buildings and structures.

Hawaii charges an excise tax in lieu of a sales tax. It is also the same if you will use Amazon FBA there. Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7.

Services refers to the sale of labor or a non-tangible benefit. Labor charges to install or repair items that become part of real estate are not taxable. This means that a carpenter repairing a roof would be required to collect sales tax while an accountant would not.

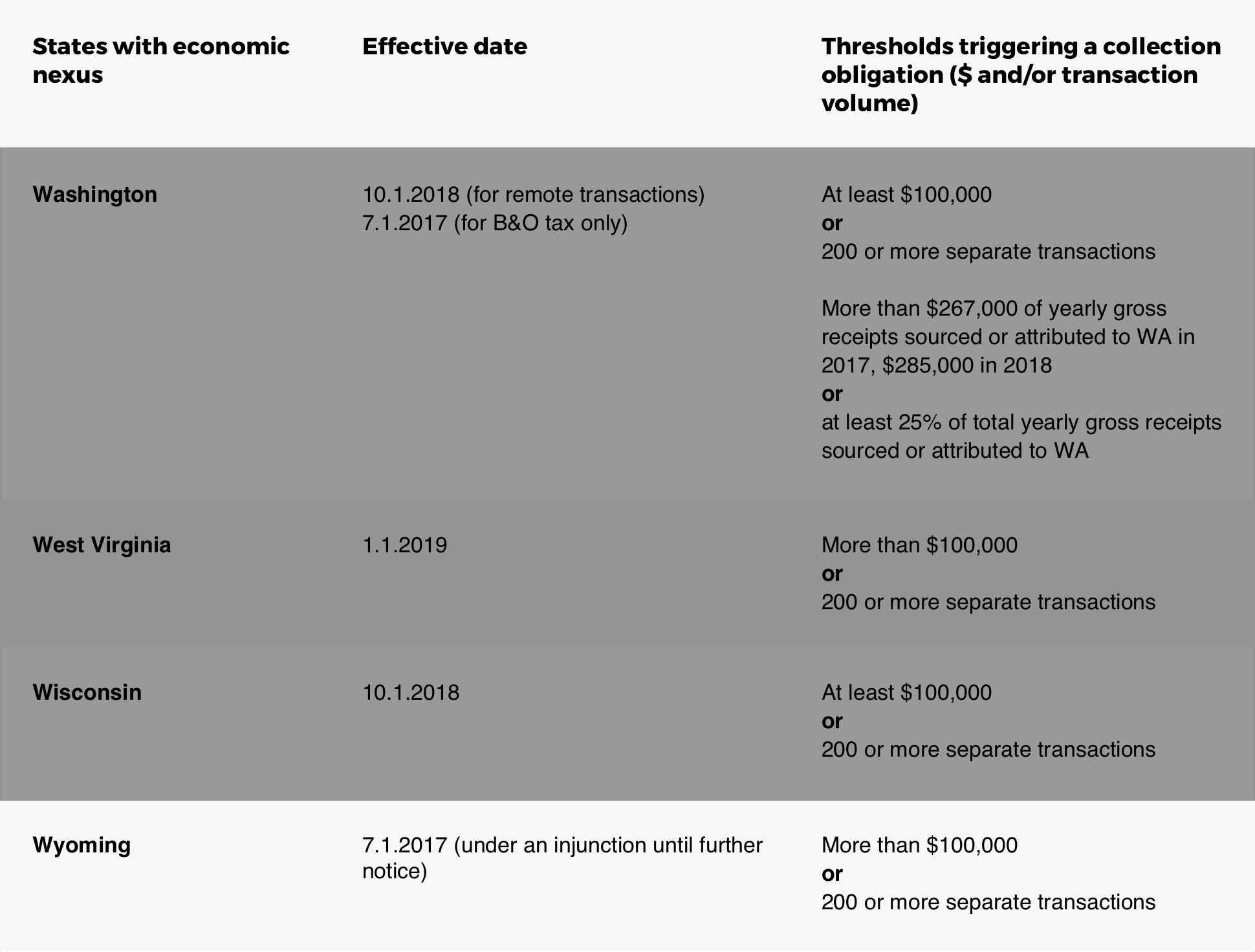

Does minnesota charge sales tax on labor. Do You Charge Sales Tax On Labor In Washington State. Wyoming is a destination-based sales tax state.

Only certain services sold performed or furnished in Wisconsin are subject to Wisconsin sales or use tax. Thus both the materials and repair labor used to construct or repair the other construction will be subject to sales tax. Are services subject to sales tax in Wyoming.

No you do not pay sales tax on labor. The state sales tax rate in Wyoming is 4. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in.

Below is a listing of service categories that are subject to sales tax when provided to consumers. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1354 for a total of 5354 when combined with the state sales tax. Labor to fabricate or repair movable property is taxable.

Generally all states who have sales tax also have a use tax and certain labor and services are taxed. Does Wyoming charge sales tax on vehicles. In California shipping is not taxable only if you charge them your exact cost to ship the item.

Permits for Nebraska Sales Tax must be obtained from an Option 1 contractor. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs alterations or improvements to tangible personal property in the scope of those services. Boat docking and storage.

The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Access or use of amusement devices. So if you live in Wyoming collecting sales tax is not very easy.

In Vermont specified services are taxable. This is the same whether you live in Wyoming or not. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

Does Ohio charge sales tax on delivery. Labor charges to construct or repair immovable or real property are not subject to sales tax. Some states are more strict than others when it comes to charging sales tax on shipping.

The maximum local tax rate allowed by. Vendor Operations is further subdivided into region specific units which handle the needs of vendors in their area. The vehicle was a taxable item hence labor to repair it is taxable This would also apply to appliances jewelry and any other taxable items.

The listing also includes some examples and links to additional resources. Insure that all new vendors are offered a face to face visit from our field. 573902 the Ohio sales tax applies to all retail sales in this state.

The only states who do not have a sales and use tax are. Should Tax Be Charged On Labor. The sales tax on 020 RSMo as well as telegraph services and telephones amounts to 8.

According to the Washington Business and Occupation Tax BO Tax businesses pay the BO tax for gross earningsIn other words there are no deductions for business-related labor materials taxes or any other costs. Does Fedex charge sales tax on shipping. Does Vermont charge sales tax on labor.

Monday Map State And Local Sales Tax Collections Tax Foundation

Wyoming Sales Tax Handbook 2022

Sales Taxes In The United States Wikiwand

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

How Much Does Your State Collect In Sales Taxes Per Capita

How Does Wyoming S Tax Structure Compare To Other States Wyofile

How Do State And Local Sales Taxes Work Tax Policy Center

Avoid Penalties By Staying Aware Of Sales Tax Laws

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

New Wyoming Online Sales Tax Rules Forix

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Liqour Taxes How High Are Distilled Spirits Taxes In Your State